10 Easy Facts About Short Term Loan Shown

Wiki Article

Excitement About Short Term Loan

Table of ContentsOur Short Term Loan IdeasThe 5-Minute Rule for Short Term LoanShort Term Loan - QuestionsSome Ideas on Short Term Loan You Need To KnowThe Facts About Short Term Loan UncoveredShort Term Loan - The Facts

In scenarios like these, lots of people turn to short-term lendings or short-term funding as a means to spend for unforeseen or difficult personal expenditures. Short-term funding is a car loan alternative that offers the recipient obtained funds for short-term expenses, similar to exactly how a brief term lending functions!.?.!? Brief term finances supply you obtained capital that you repay, plus passion, typically within a year or much less.A significant benefit of short-term financing is that they can make a big distinction for people who need immediate access to money they don't have. Short term car loan lending institutions do not place a significant focus on your credit rating for approval. A lot more essential is evidence of employment and a consistent income, details regarding your checking account, and also verifying that you do not have any impressive car loans.

Numerous sorts of brief term lendings offer outstanding adaptability, which is valuable if cash money is limited right currently yet you prepare for points obtaining much better monetarily quickly. Prior to authorizing for your short-term loan, you and the lender will certainly make a routine for payments and accept the interest prices in advance.

5 Simple Techniques For Short Term Loan

The advantage of short-term funding is that you obtain a relatively small quantity of cash right away, and you pay it back quickly (Short term loan). The complete passion settled will normally be much less than on a bigger, lasting finance that has more time for rate of interest to develop. No monetary remedy is ideal for every debtor.

This is why it is necessary to weigh your choices in order to set yourself up for success. Have a look at the three leading downsides of taking out a short term funding. The greatest downside to a short-term finance is the interest price, which is higheroften a whole lot higherthan rates of interest for longer-term car loans.

The Only Guide to Short Term Loan

In addition to repaying the temporary financing balance, the rate of interest repayments can lead to higher payments every month (Short term loan). Keep in mind that with a temporary lending, you'll be paying back the loan provider within a short duration of timewhich methods you'll be paying the high interest for a much shorter time than with a long-lasting finance.Lasting lendings may have reduced interest rates, yet you'll be paying them over numerous years. Depending on your terms, a short-term loan might actually be cheaper in the long run. While paying off a brief term car loan promptly according to your set schedule can be a considerable increase to your credit rating, falling short to do so can cause it to plunge.

This can be harmful if you only have a little or excellent credit report, and ruining to your future possibility to obtain if you already have inadequate credit. Before obtaining a brief term funding, be sincere with yourself concerning your ability as well as technique when find out it comes to paying back the financing on time.

The Facts About Short Term Loan Uncovered

Thinking about the top advantages and also disadvantages of short term financings will certainly assist you determine if this financial tool is best for your situation. The debtor returns the amount of the funding to the lending institution over the training course of months instead than years., you can easily apply for a loan either online or with a bank or credit rating union.The demands for applying for a loan are: The borrower ought to be 18 years or above Legitimate email address as well as phone number Although these are some of the needs that you might require to satisfy before making an application for a funding, you don't require to have collateral while getting a car loan.

The 3-Minute Rule for Short Term Loan

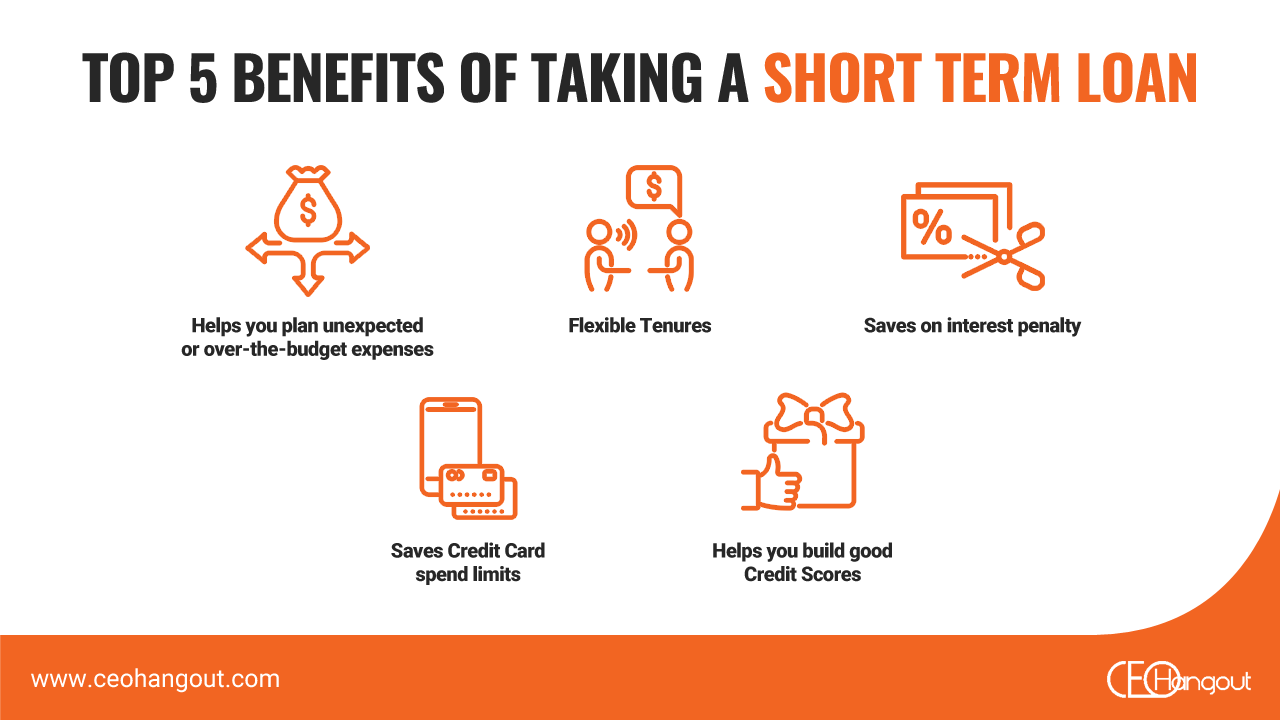

There are several advantages connected with temporary car loans. Allow's review them to assist you understand how advantageous these loans can be.

As you are applying for a temporary lending, you need to be certain adequate to settle it in the needed timeframe. Individuals of temporary financings often obtain lines of credit.

Some Known Questions About Short Term Loan.

Numerous lenders run sites that you can see straight to get a funding swiftly. Considered that you need to pay off the loan within a short duration, the stress and anxiety related to find out here settling it will certainly not last for long! So, these are all the advantages that temporary finances supply. If you remain in urgent demand of cash, what are you awaiting? Go as well as get the financing to obtain its advantages.You can merely make an application for a funding and also repay it as quickly as you earn sufficient earnings.

Report this wiki page